Conservation Easement Appraisals

Protecting Land, Preserving Value, with Trusted Appraisals

PMI Removal Appraisals

's Leading Appraisal Firm

Providing high quality appraisals of residential and commercial properties in a timely & professional manner.

's Leading Appraisal Firm

Providing high quality appraisals of residential and commercial properties in a timely & professional manner.

's Leading Appraisal Firm

Providing high quality appraisals of residential and commercial properties in a timely & professional manner.

Conservation easements can offer both meaningful benefits and important considerations for landowners. For many, placing land under conservation is a deliberate decision to protect natural, scenic, or agricultural resources for future generations. At the same time, these permanent restrictions can significantly affect how a property may be used and its long-term market value. At Appraisal Resources, Ltd., we provide clear, independent appraisals that objectively measure these impacts.

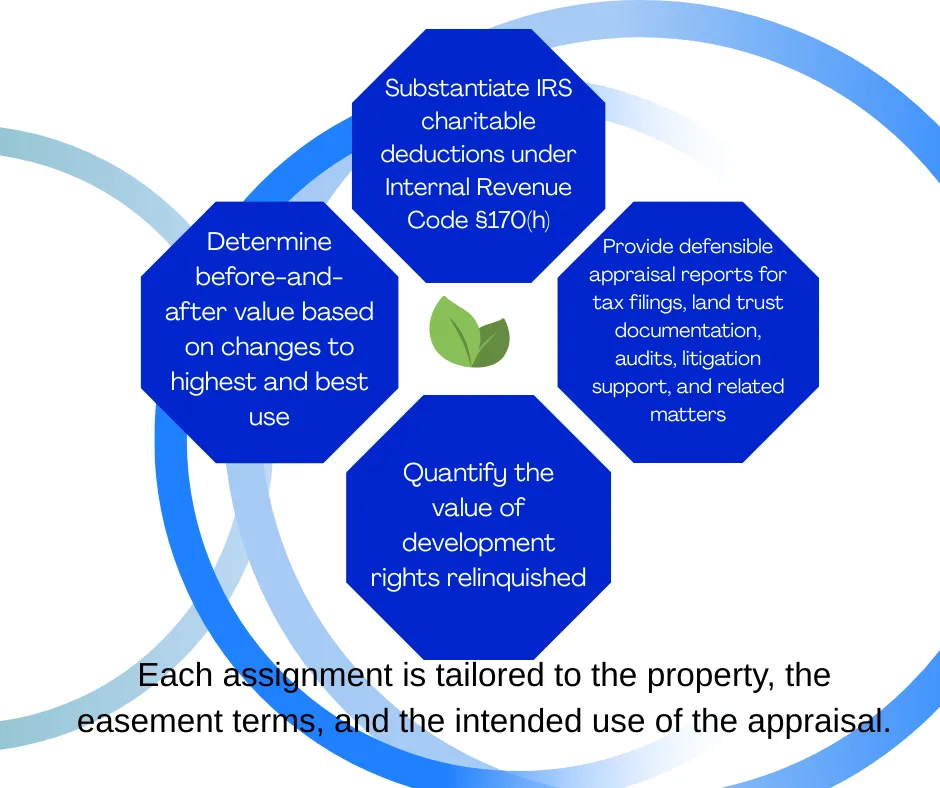

We specialize in conservation easement appraisals using the before-and-after method, which isolates the value of development rights relinquished in exchange for preservation. Our analyses are grounded in recognized appraisal methodology and reflect a careful examination of highest and best use before and after the easement is imposed.

Our appraisal reports are prepared to meet applicable IRS and land trust requirements and are designed to be accurate, defensible, and well-supported by market evidence. Each assignment is approached with attention to detail, transparency, and compliance with professional standards.

Our goal is to bring clarity and confidence to what can often be a complex and emotional process; helping landowners, families, attorneys, and conservation partners move forward with trust in the results.

We Specialize In Appraisals For:

SAVE MONEY

Choosing an appraiser you can trust can save you thousands of dollars and help you make better informed decisions.

AVOID CONFUSION

We walk you through the appraisal and make sure all of your questions are answered.

STRESS-FREE PROCESS

We will make your experience stress-free by being efficient, transparent, and simplifying the entire process for you.

Our Simple 3 Step Appraisal Process

Step 1: Connect With Us

Reach out via our website, phone, or email. We'll discuss your needs and unique situation.

Step 2: Expert Evaluation

We conduct a thorough appraisal tailored to your property, ensuring accurate and reliable results.

Step 3: Informed Decisions

With our detailed appraisal, you can make well-informed decisions with complete confidence.

Meet Jon

Click here to learn more about Jon J. Meyers, SRA.

Why We're Different

We prioritize professionalism and integrity to ensure you have the best experience with our appraisers.

Reviews

Learn why we are one of the top rated appraisal firms in the area.

Our Approach

We specialize in conservation easement appraisals using the before-and-after method, the accepted framework for valuing the development rights relinquished in a conservation transaction.

Each assignment includes:

A thorough analysis of highest and best use before the easement

A careful examination of remaining legally permissible and feasible uses after the easement

Market-supported conclusions that reflect how the easement affects value

Our reports are prepared to meet applicable IRS and land trust requirements and are developed with attention to detail, transparency, and professional standards.

Conservation Easement Appraisal Services

A conservation easement appraisal measures how permanent land-use restrictions affect a property’s market value. These appraisals are commonly required to:

Why Clients Choose Us

IRS-Qualified Reports – Reports prepared to meet §170(h) requirements and applicable appraisal standards.

Proven, Defensible Analysis – Work designed to withstand scrutiny from taxing authorities, land trusts, and courts.

Clear for Every Audience – Complex valuation issues explained clearly for attorneys, accountants, landowners, and conservation organizations.

Local Market Expertise – Specialized experience with farmland, rural tracts, and conservation properties in Northwest Ohio, supported by local market data and land-use conditions

Respect for Land and Legacy – An approach that recognizes both the financial and stewardship goals behind conservation decisions.

Who We Serve

Attorneys

– Conservation easement valuations for charitable contribution planning, IRS matters, audits, and litigation support.

Accountants & CPAs

– Reliable before-and-after value conclusions for charitable deduction reporting and tax compliance.

Landowners & Families

– Objective guidance for those conserving land while understanding the financial implications of permanently restricting development rights.

Land Trusts & Conservation Organizations

- Independent appraisals supporting easement donations, acquisitions, and stewardship documentation.

Estates & Trusts

-Valuation support for estate planning, settlement, and reporting involving conservation-restricted properties.

The Human Side of Easement Appraisals

For many landowners, land represents heritage and long-term stewardship. Donating a conservation easement is a permanent decision that protects land for future generations while also affecting property value.

Our role is to provide a clear, objective appraisal that fairly measures that impact—supporting informed conservation decisions and confidence in the outcome.

Local Expertise

We proudly serve property owners and professionals across Northwest Ohio, including:

Agricultural & Farmland Easements

Residential & Mixed-Use Property Restrictions

Utility Rights-of-Way & Access Easements

Estate Planning & Conservation Land Donations

Looking for a “conservation easement appraisal near me”? You’ve found the trusted partner.